Summary

Fubon Group has many businesses in Taiwan and has an important position in Taiwan’s economy. However, Fubon’s ambitions and ties are not limited to Taiwan. Fubon wants to expand its business footprint in China and has a friendship with Chinese entrepreneurs (for example, Jianhua Xian). Some speculate that mergers and acquisitions by Fubon help with CCP money laundering.

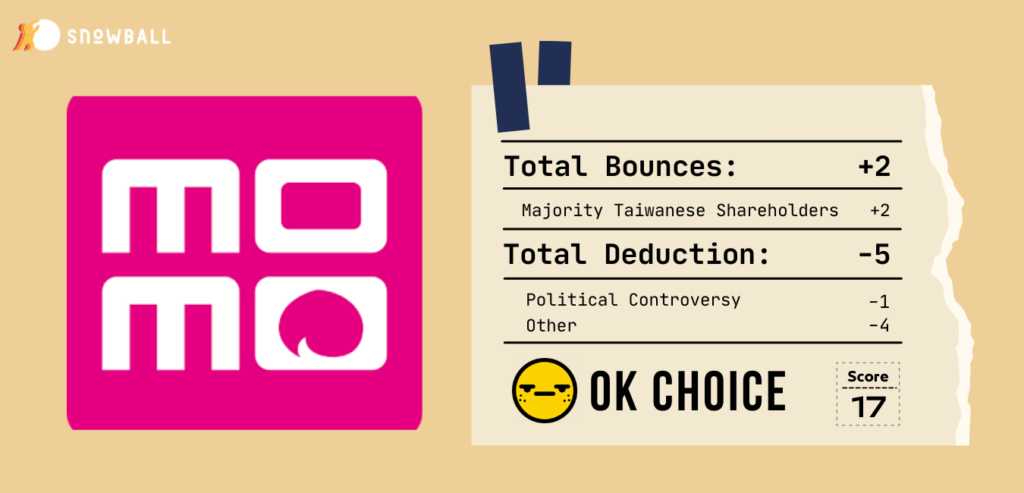

Score Analysis

Ownership, Shareholders and Political Activity: +2

The shopping site momo has many shareholders, including a Japanese company, but with a high percentage of Taiwanese holders and under Taiwanese management. Many people and media suspected that the Fubon group has a good relationship with Xiao Jianhua, who is a famous founder of the Chinese company Tomorrow Holdings Group (we can see this in the section of “Ownership, Shareholders and Political Activity”). The score for this section is +2.

Media Reputation, Public Controversy and Boycott Calls: -1

The media reputation of Fubon is surrounding the controversial allegations that former president Ma Ying-Jeou accepted political donations from Fubon. According to Tsai Mingzhong’s (蔡明忠) testimony in court, whether the donation was made in 2004 or 2008, the donation amount of 10 million or 15 million is not a small amount. However, there are no records of the 15 million donations in the 2004 and 2008 special accounts of the KMT. Where did this political donation go? Back in 2002, when former President Ma was serving as the mayor of Taipei, the Taipei Municipal Government offered to sell all the shares in the Bank of Taipei, and Fubon Financial Holdings was the only selected company. It was suspicious whether the political donation’s money had entered Ma Ying-jeou’s own pocket, and opened a convenient door to Fubon, suspected of embezzlement and bribe. So in this section, momo gets a -1 reduction on the score.

(The law of political donation in 2004.)

Other: -4

There are some other negative impressions of Fubon, like Fubon Financial mergers and acquisition with JIH SUN Financial, that is speculated to help the CCP money laundering (-3). Fubon also took over over the Kbro cable TV system and have the power to influence the channel (-1). Hence, a total of -4 is received.

Basic Information

| Ownership | Fubon Holding Group (富邦集團) |

| Leadership | 林啟峰 (富邦媒體科技股份有限公司) Fubon Multimedia Technology Co., Ltd. |

| Revenue | NT$67.20 |

| Shareholders | Majority Taiwanese Shareholders |

| Website | https://www.momoshop.com.tw/main/Main.jsp |

Data Collection

富邦媒體科技(momo)為台灣線上零售業龍頭,旗下包含momo購物網、摩天商城、電視購物及型錄購物。秉持「提供眾多物美價廉的商品及優質服務,改善人們的生活」之企業使命,以及「誠信、親切、專業、創新」四大經營價值觀,提供消費者全年無休、多元化的購物服務。

Source: http://www.fmt.com.tw/index.php?option=com_content&view=article&id=14&Itemid=15

Fubon Group is a very large enterprise and has an important economic position in Taiwan.

Check out here: https://thaubing.gcaa.org.tw/companydata/graph.html?year=2016&group=G2881

E-commerce Consumer Dispute Cases

- Shopee has 2,029 cases (the first e-commerce site has more than 2000 cases according to statistics over the years), an increase of 802 pieces from 2019 (a growth rate of 65%).

- Fubon Media Technology Co., Ltd. has 1,049 cases, an increase of 424 cases (a growth rate of 67.8%) over the previous year.

- PChome Online: 372 cases

- Ruten: 351 cases (a decrease of 19 cases compared to 2019, the only industry that dropped).

- YAHOO! TAIWAN HOLDINGS LIMITED (H.K.): 278 cases

- Eastern Home Shopping & Leisure Co., Ltd.: 164 cases

Transparency of China's influence: from the merger of Fubon and JIH SUN

Under the suspicion of Chinese investors, Fubon Financial Holdings acquired 53.84% of JIH SUN Financial Holdings through a public acquisition. The M&A case has far-reaching influence. Whether it is Fubon Financial Holdings or JIH SUN Financial Holdings, both have highly suspicious Chinese government influence.

2012 ELECTIONS: DPP urges Ma to clarify Fubon donations issue

Fubon Bank annexation of Taipei Bank

“The case was led by Ma Ying-Jeou (Taiwanese President 2008-2016) when he was the mayor of Taipei. However, this merger was not approved by the Taipei City Council and Ma Ying-jeou admitted that he had visited Fubon 5 times before agreeing to the merger. In addition, Fubon Financial Holdings, which has not yet annexed Bank of Taipei, even if the assets of Fubon Bank are added, its total asset size is still less than half of that of Bank of Taipei. The Taipei Bank of Times was incorporated as a subsidiary of its own group and changed its name to Taipei Fubon Bank, which sparked controversy.” (Wiki)

Source: